End Austerity: A Global Report on Budget Cuts and Harmful Social Reforms in 2022-25

Brief on Budget Cuts and Austerity Reforms in 2022-25 based on “End Austerity: A Global Report on Budget Cuts and Harmful Social Reforms in 2022-25” by I. Ortiz and M. Cummins

This brief alerts to the dangers of the post-pandemic austerity shock. The brief presents a summary of: (i) the incidence of austerity cuts (or “fiscal consolidation”) based on IMF fiscal expenditure projections in 189 countries until 2025 and (ii) the main austerity measures being considered by Ministries of Finance and the IMF in each country, based on a review the latest 267 IMF country reports. Instead of harmful austerity cuts, governments must urgently identify alternative financing options to support populations in this time of multiple crises. For this, see the companion pieces “Brief on Alternatives to Austerity: Fiscal Space and Financing Options for a People’s Recovery” and “Brief on What Citizens Can Do to End Austerity?”.

Today the world faces an austerity pandemic. The high levels of expenditures needed to cope with COVID-19, the resulting socioeconomic crisis and other shocks due to structural imbalances combined with reduced tax rates have left governments with growing fiscal deficits and indebtedness. Starting in 2021, this initiated a global drive toward fiscal consolidation whereby governments began adopting austerity approaches exactly when the needs of their people and economies are greatest.

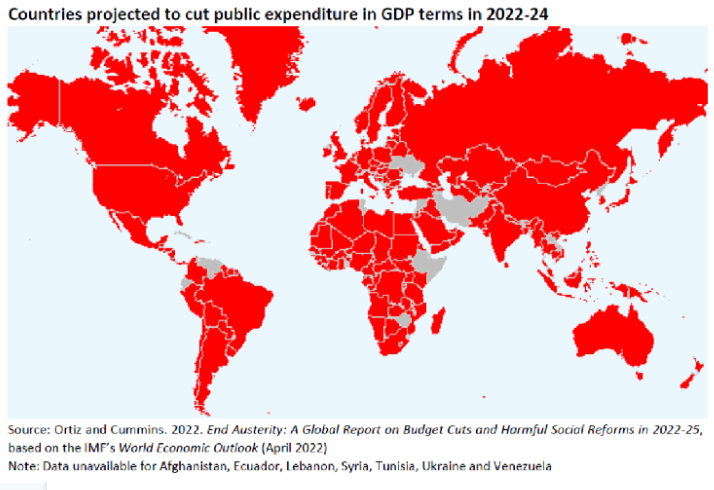

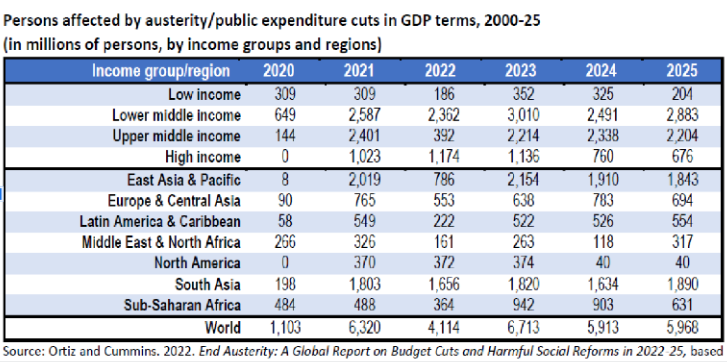

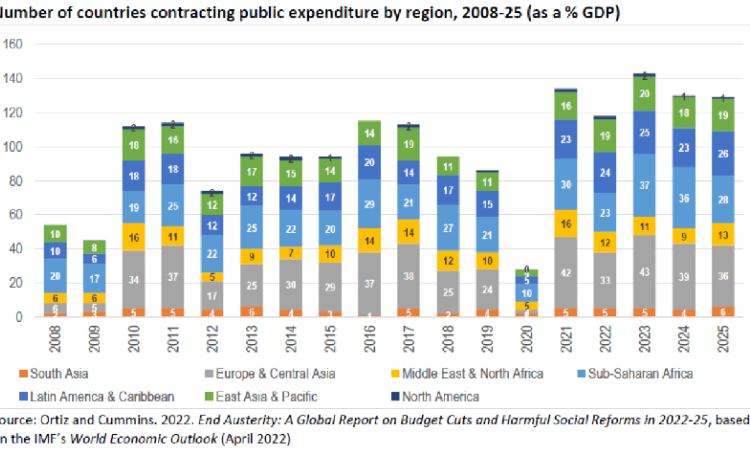

Analysis of IMF expenditure projections shows that the adjustment shock is expected to impact 143 countries in 2023 in terms of GDP or 85% of the world population. Most governments started scaling back public spending in 2021, and the number of countries slashing budgets is expected to rise through 2025. One of the key findings is that the developing world will be the most severely affected. In 2023, 94 developing countries are projected to cut public spending versus 49 high-income countries. Moreover, the average overall contraction is much bigger than in earlier shocks – 3.5% of GDP in 2021. More than 50 countries (27% of the sample) appear to be adopting excessive budget cuts, defined as spending less than the (already low) pre-pandemic levels, including countries with high developmental needs like Equatorial Guinea, Eswatini, Guyana, Liberia, Libya, Sudan, Suriname and Yemen. In terms of the human impact, austerity affected 6.3 billion persons in 2021 or more than 80% of the global population, which is expected to rise to 6.7 billion people or 85% of humanity in 2023.

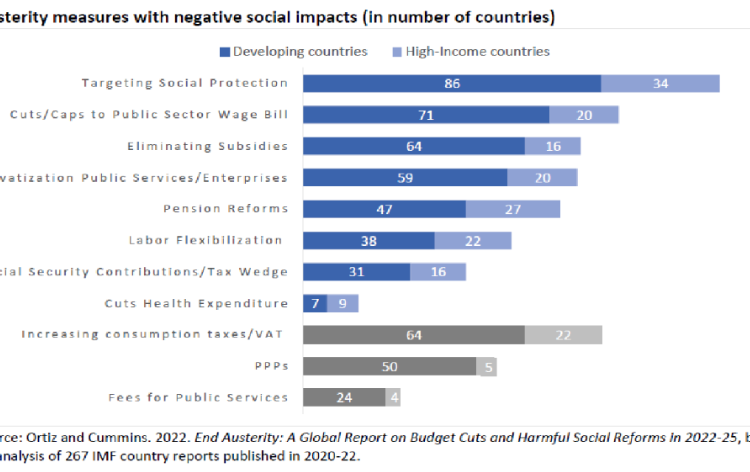

A long list of austerity measures is being considered or already implemented by governments worldwide. This includes eleven types of austerity policies that have negative social impacts on their populations, especially harming women:

- Targeting and rationalizing social protection: The review indicates that 120 governments in 88 developing and 32 high income countries are considering rationalizing spending on social assistance or safety nets, often by revising eligibility criteria and targeting to the poorest, excluding vulnerable populations in need of support. Rationalizing social protection has been commonly implemented by slashing programs for children and families, women, the unemployed, the elderly and persons with disabilities, as well as targeting scarce resources to only the extreme poor. Rather than scaling down social assistance to achieve cost savings, countries must scale up social protection systems and floors for all persons (see HRW).

- Cutting or capping the public sector wage bill: As recurrent expenditure, such as salaries for teachers, health workers and local civil servants, tends to be the largest component of national budgets, an estimated 91 governments are considering reducing their wage bill in 64 developing and 27 high income countries. This can translate into salaries being reduced or eroded in real value at a time of high inflation, payments in arrears, hiring freezes and/or employment retrenchment, all of which can adversely impact access to and the quality of public services, with disproportionate negative impacts on populations, especially on women. Additionally, most teachers, health personnel and social workers are women. The number and salaries of civil servants must be increased, not decreased, to achieve human rights and the Sustainable Development Goals (SDGs) (see ActionAid).

- Eliminating or reducing subsidies: Overall, 80 governments in 55 developing and 25 high income countries are limiting subsidies, predominately on energy (fuel, electricity), food and agricultural inputs. This adjustment measure is being implemented at a time when the prices of many basic goods and services hover near record highs; if basic subsidies are withdrawn, energy, food, fertilizer and transport costs increase and will become unaffordable for many households. While the climate crisis demands urgent progress with the phasing out of fuel subsidies, it is important that this be carried out taking into account the risks of further eroding the disposable income of families (at this time of high inflation) and job losses (due to slowing economic output). Priority should go to developing sustainable agriculture and energy alternatives. Adequate compensation must be provided to all through universal social protection systems, not just a small safety net for the poorest segments, to ensure that food, transport and energy remain affordable for populations (see Oxfam).

- Privatization of public services/Reform of State-Owned Enterprises (SOEs): Despite the many privatization failures recorded in recent years (and recent re-nationalizations in water, transport, energy, pensions and others), privatization is being considered by 79 governments in 59 developing and 20 high income countries. Sometimes SOEs are reformed as a precursor to privatization, without prior analysis of the social impacts. While sales proceeds produce short-term gains, the losses over the long-term can be significant due to lost future revenues; further, when states are faced with the need to re-nationalize, this most often comes at a high cost. Privatization risks include layoffs, tariff increases, and unaffordable and/or low-quality basic goods and services. Instead, governments must invest in affordable quality public services, from education and health to water supply and transport (see PSI and BWP).

- Reforming pensions: Reforming old-age pensions with a fiscal objective is one of the most common adjustment measures, being considered by 74 governments in 55 developing and 19 high income countries. Pension reforms can include raising workers’ contribution rates, decreasing employers’ social security contributions, lengthening eligibility periods, reducing pension tax exemptions, prolonging the retirement age, lowering benefits, eliminating/penalizing early retirement, freezing or lowering pension indexation below inflation levels, or modifying calculation formulas downwards. Despite the failures of pension privatization, some governments are also considering structural changes, such as introducing individual accounts, eliminating defined benefit (collective) pensions and replacing with defined contribution (individualized savings). Pension reforms often violate international standards. As a result, future pensioners are expected to receive lower benefits, and old-age poverty and inequalities are increasing in many places. Instead of undermining public pension systems, they should be strengthened in accordance with international standards, including by adequate employers’ contributions and formalizing workers in the informal economy to ensure sustainability, with benefits that guarantee dignity in old-age retirement (see ITUC).

- Labor flexibilization reforms: These include restraining the minimum wage, limiting salary adjustments, decentralizing, limiting or eliminating collective bargaining, increasing the ability of enterprises to fire employees, and making it easier to hire workers on temporary/atypical and precarious contracts. Some 60 governments in 44 developing and 16 high income countries are considering some form of labor flexibilization, at a time when high inflation is further reducing real wages, increasing the cost-of-living crisis and contributing to social unrest. Labor flexibilization is aimed at increasing competitiveness and supporting business in the context of recession. However, available evidence suggests these reforms will not generate decent jobs; to the contrary, in a context of economic slowdown, they are likely to generate more precarious labor markets, depress domestic incomes and ultimately hinder recovery efforts. Instead, countries must increase wages and decent jobs for people.

- Reducing employers’ social security contributions (“tax wedge”): At least 47 governments in 14 high income and 33 developing countries have waived or reduced employers’ social security contributions to support enterprises during the COVID-19 pandemic. This is a highly regressive policy since these contributions are a deferred wage of workers, part of their compensation, not a tax. If employers’ contribution rates were waived/reduced, they must subsequently be increased again and all arrears paid back to social security, to ensure its sustainability and protect workers’ rights (see ILO).

- Cutting health expenditures: While most governments were advised by the IMF to temporarily increase health allocations to fight the COVID-19 pandemic, some reports contain advise to reduce health expenditures once the pandemic is over. Cuts are being discussed by 16 governments in 7 developing and 9 high income countries. Typically, health reforms include increased charges for health services, reductions in medical personnel, cost-saving measures in public healthcare centers, discontinuation of allowances, phase-out of treatments and services, and increased copayments for pharmaceuticals. Yet countries need more than just a temporary increase in health expenditure to deal with the COVID-19 emergency; their populations need sustained investments to implement universal access to quality healthcare (see TWN and Wemos).

- Increasing consumption taxes/VAT on goods and services: This includes increasing or expanding VAT rates or sales taxes or by removing exemptions in as many as 86 governments in 64 developing and 22 high income countries. Increasing the cost of basic goods and services, however, erodes the already limited incomes of vulnerable households and stifles economic activity. Moreover, because this policy does not differentiate between consumers, it is regressive. Consumption-based taxes reduce poorer households’ disposable income, which further exacerbates existing inequalities. In contrast, alternative progressive tax approaches should be considered, such as taxes on personal and corporate income, including on the financial sector, wealth, inheritance, property, digital services or ending ‘special economic zones’ and other tax exemptions/breaks to big corporations (see GATJ and Oxfam).

- Strengthening public-private partnerships (PPPs): 55 IMF country reports suggested strengthening PPPs as a way forward, which includes 40 developing countries and 15 high income countries. However, there are many downsides to using PPPs, including their high costs, increased public and consumer spending, high contingent liabilities, efficiency issues and adverse impacts on workers. There is good evidence that PPPs strengthen the private partner at the expense of the public partner, creating a public subsidy flow to the private sector. Governments should resist pressures and consider cost-effective public infrastructure and services (see Eurodad).

- Fees/tariffs for public services: As many as 28 governments, in 6 high income and 22 developing, are advised to introduce or increase fees or tariffs for public services. Note that the actual number of countries raising fees and tariffs is already much higher, as the practice is prevalent in countries that have privatized or reformed their public services. Rate hikes may lead to goods and services being unaffordable for populations —this is particularly important for access to essential services such as water, education, health, energy and transport (see ActionAid, BWP).

Rather than investing in a robust post-pandemic recovery to bring prosperity to all citizens, governments are considering austerity measures that will harm populations. These adjustment measures are not new: the same policies have been advised over the years by the international financial institutions (IFIs). Austerity is an outdated policy that has become the “new normal,” an IFI strategy to minimize the public sector and the welfare state –to support the private sector. Countries constrained by debt and deficits are told to adopt fiscal consolidation or austerity measures rather than identifying new sources of fiscal space. Once budgets are contracting, governments must look at policies that minimize the public sector and expand PPPs and the private delivery of services, often promoted and/or assisted by multilateral development banks. These policies principally benefit corporations and the wealthy –they are “pro-rich policies” that exacerbate inequalities. To compensate for the negative social impacts, particularly on women, the IFIs often advise a small safety net targeted to only the poorest populations, which excludes the vast majority of people, punishing the low and middle classes. Pro-corporate policies accompanied by a small safety net targeted to the poorest do not serve the mainstream population; they are detrimental to the majority of citizens, especially women. The worldwide propensity toward fiscal consolidation is expected to aggravate social hardship at a time of high development needs, soaring inequalities and social discontent.

It is alarming that trillions of dollars are used to support corporations, while the costs of adjustment are thrust upon populations. Governments should aim to bring prosperity and welfare for all. The dangers of overly-aggressive austerity are clear from the past decade of adjustment. From 2010-19, billions of lives were upended by reduced pensions and social protection benefits, cuts to programs for women, children, the elderly, persons with disabilities, informal workers, ethnic minorities; by lesser and lower paid teachers, health and local civil servants; less employment security for workers, as labor regulations were dismantled; by lower subsidies and higher prices due to consumption taxes, which further reduced disposable income following the significant job losses caused by lesser economic activity.

Austerity cuts are not inevitable, there are alternatives. There is no need for populations to endure adjustment cuts: instead of cutting public expenditures, governments can increase revenues to finance a people’s recovery. There are at least nine financing alternatives, available even in the poorest countries. These nine fiscal space financing options are supported by policy statements of the UN and the IFIs, and have been implemented by governments around the world for years. These include: (1) increasing progressive tax revenues, (2) restructuring/eliminating debt, (3) eradicating illicit financial flows, (4) increasing social security contributions and coverage, including adequate employers contributions and formalizing workers in the informal economy with decent contracts, (5) using fiscal and foreign exchange reserves, (6) re-allocating public expenditures, (7) adopting a more accommodating macroeconomic framework, (8) lobbying for ODA and transfers, and (9) new Special Drawing Rights (SDRs) allocations.

There is a global campaign to stop austerity measures that have negative social impacts: End Austerity. Citizens have challenged and sometimes successfully reversed austerity measures over the past decade. Fiscal decisions on expenditure cuts affect the lives of millions of people and cannot be taken behind closed doors by a few technocrats at finance ministries, with the support of the IFIs. As part of good governance, these policies must be agreed transparently in national social dialogue, negotiating with representative trade unions, employer federations and CSOs. A fundamental human rights principle is precisely that States must utilize the maximum amount of resources to realize human rights. It is imperative that governments and international financial institutions redress austerity and other policies that benefit few, and instead explore all possible alternatives to expand fiscal space to ensure a post-pandemic people’s recovery, achievement of human rights and the SDGs.

Read more:

What Citizens Can Do to End Austerity?

| This brief is based on “End Austerity: A Global Report on Budget Cuts and Harmful Social Reforms in 2022-25” ©Isabel Ortiz and Matthew Cummins. Published by ActionAid, Arab Watch Coalition (AWC), Eurodad, Financial Transparency Coalition (FTC), Global Social Justice, International Trade Union Confederation (ITUC), Latindadd, Public Services International (PSI), The Bretton Woods Project, Third World Network (TWN) and Wemos. Check details on your country and more here (link).

For more materials, visit the END AUSTERITY campaign website: https://www.endausterity.org/ |